The mergers and acquisitions (M&A) consulting space is experiencing a dynamic shift, driven by evolving market forces, technological advancements, and a renewed emphasis on strategic alignment. As global M&A activity continues to oscillate between market opportunities and economic headwinds, consulting firms are stepping up their game to help clients navigate complexities, mitigate risks, and achieve sustainable growth.

The integration of advanced analytics, artificial intelligence (AI), and machine learning (ML) tools is revolutionizing the due diligence process. Firms are leveraging predictive analytics to assess deal potential, identify synergies, and pinpoint risks with greater precision. This shift is reducing the time required for evaluations while enhancing accuracy, enabling clients to make more informed decisions.

Additionally, tools like natural language processing (NLP) are being deployed to sift through massive datasets, including legal documents, financial statements, and market reports. The result? A comprehensive view of potential targets or partners that goes beyond traditional evaluation metrics.

With globalization persisting despite geopolitical tensions, crossborder M&A remains a key area of focus. Consulting firms are enhancing their expertise in regulatory compliance, tax optimization, and international market dynamics to support clients navigating complex cross-border deals. M&A consulting is becoming increasingly sector-focused, with firms developing deep expertise in industries such as healthcare, technology, financial services, and renewable energy. For example, in the technology sector, advisors are helping clients address unique challenges like intellectual property (IP) valuation and cybersecurity risk assessment.

The M&A consulting space is evolving to meet the demands of an increasingly complex and competitive market. By leveraging technology, focusing on ESG, and developing industry-specific expertise, consulting firms are positioning themselves as indispensable partners in the deal-making process. As companies seek growth through strategic acquisitions, the role of M&A consultants will only grow in importance, shaping the future of business at a global scale.

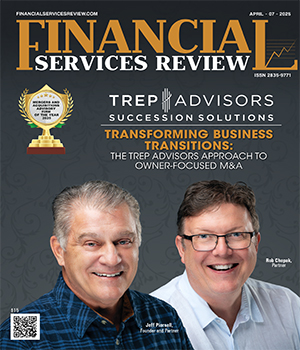

In this edition, we have featured TREP Advisors. Unlike larger, impersonal M&A firms, the company stands out by taking a deeply personalized, owner-first approach.