Rapid innovation, regulatory shifts, and evolving client expectations are reshaping how financial services operate and deliver value. This transformation is evident in the growing popularity of self-directed retirement services, enhanced receivables and collection practices, and increased demand for cryptocurrency tax support.

To meet the needs of a more diverse and regulations-conscious client base, providers are expanding their offerings. Self-directed retirement services are gaining momentum, allowing individuals to invest in alternative assets such as real estate and private ventures. These platforms broaden investment access and simplify compliance, encouraging informed decisions and long-term financial security.

On the enterprise front, receivables and collection management solutions are evolving to boost recovery rates and improve payment management. By integrating strong compliance frameworks with data driven insights, these services enhance cash flow and preserve customer relationships. And as financial activity increasingly moves online, accurate and timely tax reporting has become critical. Financial services firms now offer specialized solutions to help clients navigate complex regulations, ensuring transparency, compliance, and peace of mind.

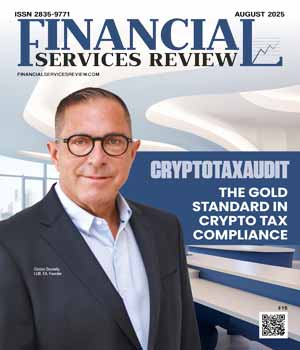

In this edition of Financial Services Review, we spotlight leading companies in self-directed retirement, receivables and collections, and crypto tax support. These firms stand out for their ability to help clients diversify portfolios, streamline operations, and manage regulatory challenges with confidence.

Adding depth to this issue, we share insights from Roy Hock, Director of Risk Finance and Casualty Insurance at Valero and, Steven Shafer, treasury innovations team manager at Bremer Bank, who bring valuable perspective to today’s evolving financial landscape.

We hope this edition offers a clear perspective on a sector where innovation, control, and compliance must work in harmony. We welcome your thoughts on this ongoing transformation.